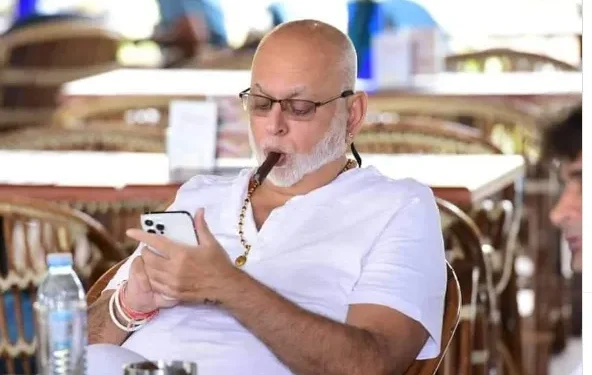

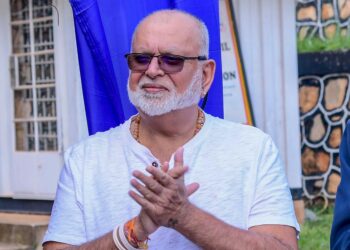

In Uganda, the name Sudhir Ruparelia is almost always linked with wealth and success. For more than two decades, the billionaire businessman has remained firmly at the top of the country’s rich list. Many Ugandans have watched his rise with both admiration and curiosity, and what is clear is that his position is not about to change. If anything, the next twenty years may see his fortune grow even larger, further strengthening his status as one of the most influential business figures in the region.

What sets Sudhir apart is that he is not only a businessman chasing profits, he is also a careful planner and strategist. The Ruparelia Group, which he founded and leads, is spread across several important industries. These include banking, real estate, education, agriculture, hospitality, and media. These are not just areas that bring in money, they are also key pillars of Uganda’s economy. Because of that, his empire is well protected from sudden economic shocks and changes.

One of the clearest examples of his foresight is his investment in real estate. Kampala’s cityscape has been transformed by developments linked to Sudhir. From the well-known Speke Apartments to the modern Kingdom Kampala Mall, his properties stand as landmarks in the capital. Uganda’s population continues to grow, and urbanisation is moving at a fast pace. This means that demand for places to live, office buildings for businesses, and commercial spaces for shopping will keep rising. As a result, his properties will keep generating rental income while also gaining value over time, creating both immediate and long-term wealth.

Education is another area where Sudhir has left a strong mark. Through institutions such as Kampala Parents School, Delhi Public School International, and Victoria University, he has built a reputation for investing in learning. Unlike some businesses that may decline during hard times, education continues to attract demand because families always prioritise the future of their children. Even in difficult economic conditions, Ugandan parents make sacrifices to ensure their children get quality education. This makes Sudhir’s investment in schools and universities one of the most stable sources of revenue within his empire.

Another major reason for his staying power is his ability to recognise opportunities before others see them. In the 1990s, when the banking sector was opening up, he launched Crane Bank, which grew rapidly and became one of the most trusted local banks at the time. When real estate began to boom, he was among the first to invest heavily, placing himself at the centre of Kampala’s property development. Later, he expanded into tourism and hospitality, setting up a chain of hotels and resorts under the Speke brand, which today attracts both local and international visitors. This pattern of anticipating trends and moving quickly has allowed him to stay ahead while many other wealthy Ugandans have struggled to keep up.

Some observers believe that wealth is never permanent and that new players will eventually take over. Uganda, after all, is producing more millionaires every year. While that is true, building an empire of Sudhir’s scale requires much more than money alone. It takes networks that are built over decades, an understanding of how markets work, and the patience to allow investments to grow. Sudhir has strong connections with government officials, international financiers, and influential investors. These ties give him a reach and influence that very few of his competitors can match.

It is also important to recognise that the Ugandan business environment comes with its fair share of risks. Changes in tax regulations, political uncertainty, and global economic shocks all present challenges to entrepreneurs. Sudhir himself has faced difficulties, most notably the collapse of Crane Bank. Yet what makes his story stand out is how he responded. Instead of retreating after that crisis, he reinvented himself, put more focus on other ventures, and expanded his presence in sectors like hospitality and education. This resilience has become one of his strongest traits, proving that setbacks do not define him, but rather push him to adapt and grow stronger.

Looking at the bigger picture, Sudhir Ruparelia’s empire represents a model for building lasting wealth in Uganda. His approach is not about short-term gains but about diversification, reinvestment, and long-term vision. By spreading his interests across different industries, strengthening them over time, and staying flexible when challenges arise, he has built a foundation that can survive economic storms. Unless Uganda faces an extraordinary crisis that shakes the entire economy, it is very likely that Sudhir Ruparelia will remain the richest man in the country, not just now but for at least the next two decades.

His story is a reminder that true wealth is not only about making money. It is about planning, patience, and the ability to see opportunities before others do. Sudhir’s empire, shaped over decades, is a clear example of business built to last.