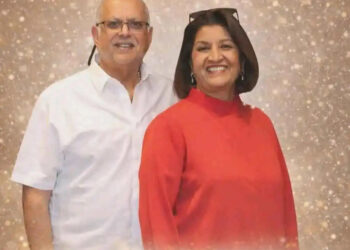

The Supreme Court of Uganda has delivered another decisive judgment in favor of businessman Dr. Sudhir Ruparelia and his company Meera Investments Limited, ordering the Bank of Uganda to pay them a combined Shs 1 billion in legal costs over the long-running Crane Bank dispute.

A panel of three justices, led by Chief Justice Alfonse Owiny Dollo, with Justices Elizabeth Musoke and Stephen Musota, made the ruling on October 17, 2025, following an appeal by Sudhir and Meera challenging an earlier decision that had drastically reduced their legal cost award.

The Court found that both Sudhir and Meera were separate legal entities entitled to individual payments of Shs 500 million each, bringing the total payable by the Bank of Uganda to Shs 1 billion. The judgment partly upheld an earlier decision by Justice Mike Chibita but clarified that it was wrong to treat Sudhir and Meera as a single party since they were each sued in their own right.

Chief Justice Owiny Dollo noted that the law does not prevent more than one party represented by the same lawyer from submitting separate bills of costs. He said the only costs that should be rejected are those that are duplicated or unnecessary.

The ruling adds to a series of courtroom victories for Sudhir and Meera, who have fought a nearly decade-long legal battle following the controversial closure of Crane Bank in 2016. The Bank of Uganda took over the bank, claiming it was undercapitalized, and later sold its assets to DFCU Bank under circumstances that have since been widely criticized as irregular and unlawful.

In 2017, the central bank, acting through the defunct Crane Bank (in receivership), sued Sudhir and Meera Investments, accusing them of misappropriating huge sums of money and illegally taking over 48 branch properties. The High Court dismissed the case in 2018, ruling that Crane Bank in receivership had no legal capacity to sue. The Court of Appeal upheld the decision, and in 2021, the Supreme Court confirmed that position, declaring that the Bank of Uganda could not use the name of a bank that no longer existed to pursue legal action.

After the victory, Sudhir and Meera sought to recover their legal costs, filing bills that totaled more than Shs 54 billion each, reflecting years of legal work and court appearances. The Supreme Court Registrar had valued the claim at Shs 458 billion and awarded Shs 45.8 billion in legal fees. However, the Bank of Uganda objected, and Justice Chibita later reduced the amount to Shs 500 million, which Sudhir and Meera appealed.

In its latest ruling, the Supreme Court maintained that while the earlier Shs 45.8 billion award was excessive, the Bank of Uganda was still responsible for paying reasonable costs. Chief Justice Owiny Dollo explained that the case before the Supreme Court was not about money but about a point of law — specifically, whether Crane Bank in receivership could legally sue.

He said it was wrong to calculate fees based on the alleged Shs 458 billion claim because the appeal had nothing to do with that figure. The Chief Justice also stated that the issues raised were not complex or novel and that instruction fees should be reasonable so that justice remains accessible to all.

Justice Musoke fully agreed with the Chief Justice, while Justice Musota partly dissented, saying the applicants deserved a slightly higher award because of the scale and length of the litigation.

The Supreme Court also upheld the earlier decision to limit interlocutory costs to Shs 5 million per application, instead of the Shs 50 million initially awarded, and confirmed that all other charges — including drawings, attendances, and perusals — were already covered under instruction fees.

The Court reaffirmed that it is the Bank of Uganda, not Crane Bank, that must pay the Shs 1 billion since the central bank was the real party behind the lawsuit. Chief Justice Owiny Dollo noted that the courts had lifted the corporate veil over Crane Bank, exposing the Bank of Uganda as the actual entity responsible for initiating and financing the case.

The decision effectively closes another chapter in Uganda’s most high-profile banking dispute. It also reinforces findings by Parliament, the Auditor General, and multiple courts that the Bank of Uganda mishandled the closure and sale of Crane Bank.

The Auditor General’s 2018 report revealed that the central bank could not account for Shs 478 billion it claimed to have spent during receivership. It also noted that the sale to DFCU Bank was conducted without transparency or open bidding, in violation of proper procedures.

Crane Bank, once among Uganda’s largest and most profitable banks, was owned by Sudhir through Meera Investments Limited. Its sudden closure, followed by years of court battles, sparked national debate about the Bank of Uganda’s regulatory conduct and accountability.

For Sudhir Ruparelia and Meera Investments, the Supreme Court ruling stands as another legal vindication — confirming that the closure of Crane Bank was illegal, and that the Bank of Uganda acted outside the law. It also reaffirms their right to compensation for the years of wrongful litigation that followed.